In this article, we are going to help you out with decisions like how and when to exit a trade.

Formulating an Exit Strategy

Determining the best time to call quits on your trade requires that you have ample knowledge on the subject. It isn’t simply a matter of selling or buying when the mood strikes. Instead, create appropriate exit strategies to ensure you are functioning profitably. There are generally two types of exit strategies, namely, Take Profit (T/P) and Stop Loss (S/L). Let’s now look at how these function and how you can implement them.

Take Profit and Stop Loss

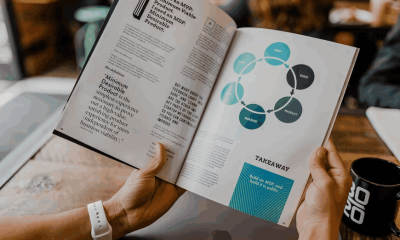

Take Profit and Stop Loss are two of the ways you can exit a trade. Stop loss refers to setting a point either below or above your current market price and can help you out in case a market goes in an unfavorable direction. The process involves setting criteria upon which your equities will be automatically sold. Similarly, take profit works with two exceptions. You cannot set a “trailing point” which works unfavorably with profits and you cannot set the Take Profit point below the market price. Determining T/Ps and S/Ps can also help you identify whether a trade is worth taking. By analyzing how much profit you can derive over the risks you can know if the trade is your best option. Since the data is available as a graphical representation, it will also help you avoid overinvesting in any trade which many traders regret later.

Closing The Deal

Closing the deal in trading refers to closing any open positions to either get profits or prevent losses. The trading market is unpredictable and being prepared for any situation will enable you to draw back when the timing is right. If the market is moving unfavorably you may sell any open stocks to avoid or minimize losses. Alternatively, if the market is moving in your favor you may sell your stocks to make higher profits than you would otherwise.

Rolling

Rolling basically means changing your strike point by updating the conditions. If you realize your stocks aren’t doing well or about to expire you can close them out and buy them again with a new expiration date. This can increase the longevity of your expenditure in case you want to stick for a longer period.

Factors Influencing The Strategy

Developing your very own exit strategy is fundamental when getting into any trade. It can determine whether you benefit from the trade or experience a loss. However, exit strategies are not always so simple. You will need to deal with several factors that can affect your strategy. These can range from technical factors like the nature of the market to more personal factors like emotions. Nevertheless, you must have good command over these to ensure an effective exit strategy.

Timing

Timing is of fundamental importance to any trading expenditure. A few seconds can be fateful in deciding whether you make profits or experience a loss. You must be punctual and know when the right time is to buy or sell a stock.

Emotion And Impulse

Many traders let their emotions cloud their judgment when buying or selling stocks. Ultimately when you see a market rising rapidly or crashing the impulses to buy or sell may overcome your ability to think rationally. Always be sure you stick by the rules and trade with a rational mind.

History And Research

Researching previous patterns can help you out when developing your exit strategy. Knowing how the market responds to a particular set of conditions (an event, time of the day, etc.) will help you predict where the market will go. Make sure you fully study the market and take into account any unexpected behaviors when creating the strategy. Heeding too much attention to the perfect exit strategy is a lost cause since there is no perfect strategy. You must be open to any new developments and learn to roll with them. Trading also requires that you are willing to lose anything you put forward. Everyone makes losses one time or another and keeping these tips in mind will help you stay in trading for the long term. Thank you for visiting techfollows.com.